How To Find My Income Tax Check

Check your refund condition online 24/7!

Bank check your refund status online 24/7!

- Select the tax year for the refund status you want to check.

- Enter your Social Security number.

- Choose the course you filed from the drop-down carte du jour.

- Enter the amount of the New York State refund you requested. Encounter Refund amount requested to learn how to locate this amount.

Note: To check the status of an amended return, telephone call us at 518-457-5149

Check refund status

Para español, llámenos al 518-457-5149—oprima el dos.

- Language:

- English language

- Español

- 中文版

- Русская версия

- বাঙালি

- Kreyòl ayisyen

- 한국어

- Gratuitous interpretation services

Understanding your refund status

Equally you track the status of your return, you'll encounter some or all of the steps highlighted beneath. For more information about your status and for troubleshooting tips, run across Agreement your refund condition.

Desire more data most refunds? See these resources:

- Respond to a alphabetic character

- Your refund was adjusted

To receive a notification when your refund is issued and other electronic communications nigh your income tax refund see Request electronic communications from the department.

We do not have whatsoever information nearly your render at this fourth dimension. E-filed returns could have one week to mail service to our system; mailed returns can take upwards to three weeks to post to our system. If you lot e-filed, check your e-mail, tax software or tax preparer to ensure it has been accustomed.

This refund status will continue to display until your return posts to our system; then you lot volition go an updated status.

We take received your return and it is being processed. No further information is available at this fourth dimension.

This is a general processing condition. Unless your return is selected for additional review, or nosotros asking additional information, this will be your status throughout processing until we schedule an issue date and update your status at that fourth dimension. While your return is in this stage, our Call Center representatives have no farther data available to assist you. As your refund status changes, this message will automatically update in our automated phone arrangement, our online Check your refund status awarding, and in the account information bachelor to our representatives.

We received your return and may require further review. This may result in your New York Country return taking longer to process than your federal render. No further information is available at this time.

Once we receive your return and brainstorm to procedure it, our automated processing system scans it for any errors or signs of fraud. Depending on the result of that scan, we may need to manually review it. This condition may update to processing once more, or you may receive a request for additional information. Your render may remain in this stage for an extended period of time to let us to review. In one case you lot return to the processing phase, your render may exist selected for additional review earlier completing processing.

When we upshot a refund, we will deliver one of the following messages.

- Your return has been processed. A direct deposit of your refund is scheduled to be issued on (date mm/dd/yyyy). If your refund is not credited to your account within 15 days of this date, check with your banking company to find out if it has been received. If it'southward been more than 15 days since your direct deposit issue date and you haven't received it withal, run across Direct deposit troubleshooting tips.

- Your refund cheque is scheduled to be mailed on (mm/dd/yyyy). If yous have not received your refund within 30 days of this date, telephone call 518-457-5149.

Request electronic communications from the department

The all-time manner to communicate with the Tax Section nigh your return is to open up an Online Services business relationship and asking electronic communications for both Bills and Related Notices and Other Notifications. To ensure that you receive future communications in the Message Center of your Online Services Account Summary homepage, create your account now, before filing your next return.

- LOG IN

- create account

Once y'all've logged in to your Online Services account:

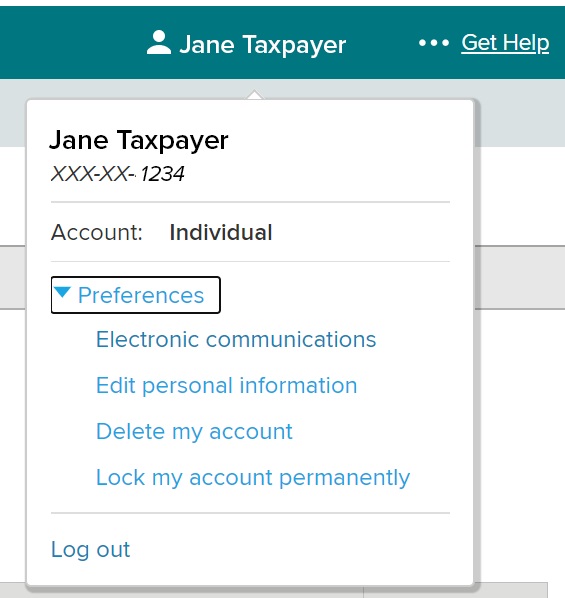

- Select your name in the upper right-hand corner of your Account Summary homepage.

- Select Preferences, and then select Electronic communications from the expanded menu.

Sample of Individuals business relationship blazon in Online Services

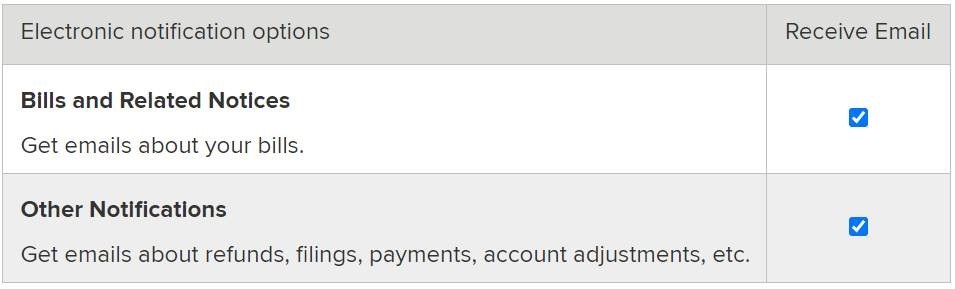

- Choose the Electronic notification options you lot want to receive email about. To receive a notification when your refund is issued and other electronic communications near your income revenue enhancement refund, select both options.

Sample of Bills and Related Notices screen in Online Services.

- Read the Acknowledgement section.

- Select Save.

Updated:

Source: https://www.tax.ny.gov/pit/file/refund.htm

Posted by: salazarlinut1989.blogspot.com

0 Response to "How To Find My Income Tax Check"

Post a Comment